These little walks down memory lane, like yesterday’s piece on Mt. St. Helens, always seem to stir up something else… that I likely haven’t thought of in ages. Indeed, yesterday’s piece started off about a Sunday morning, with me describing how I was just sitting there reading… and nobody has asked me what I was reading, but I will tell you anyway… it was the stock-exchange listings from the previous night’s Vancouver Sun. And if you’re wondering why is an 11-year-old kid was reading stock prices on a Sunday morning 40 years ago, I’ll tell you…

Our grade-6 teacher had created a very cool one-month project. We would all get to buy and sell stocks, all starting with a virtual $1,000, and he would track it on a big chart in the classroom. Every day, we would submit our “trades” — buy this many shares at this price, sell this many at that price. He would do the math and track everyone’s profit/loss. We would submit our trades every morning, along with where we’d gotten the price — The Vancouver Sun or The Province.

There wasn’t really much research that could be done on it… at best, you’d have day-old news to contemplate, and anyway, we were in grade 6… who’s doing any sort of real research, and even if we did, to what end… whatever we might come up with would already have been built into the stock price. But it was a fun exercise, and of course, it grew very competitive, watching everyone’s graph-lines wiggle up and down from day to day. For the most part, people were picking stocks by names that sounded good, or maybe familiar. By the end of two weeks, a few lines had started to separate upwards… and I wasn’t one of them, and it was bothering me. And it didn’t seem like lucky guesses. These guys knew something.

As it turns out, indeed they did; their fathers were stock-brokers or somehow involved in business where they had access to better information. My dad was a mining engineer, so at best he suggested a few mining companies that were exploring for gold… but they weren’t going anywhere in a hurry. I needed to find an edge.

Arbitrage is the simultaneous purchasing and selling of an asset, where the buy price is lower than the sell price, so the transaction generates an instant and risk-free positive return. The most common place where this takes place is financial markets, where, for example, a certain stock may be listed on multiple exchanges. If you have instant access to both markets and notice that shares of ABC are offered for $10⅛ on one and being bid at $10⅜ on another, you buy the cheap one, sell the expensive one, and deliver the cheap ones to the guy that bought the expensive ones. This all happens instantly, and while making ¼ on that transaction may not sound like much, it certainly adds up when you do it 1,000 shares at a time, multiple times a day. There are armies of supercomputers trying to do this continually, all day these days, and to some extent, that serves a useful purpose… it keeps prices in check. As soon as an opportunity arises, some arb grabs it instantly, and the advantage is gone.

And what I had stumbled upon a few days earlier was this… perhaps an opportunity for manual arbitrage, though at the time, I did’t even know that word… all I knew was that, on the same day, the prices listed in The Vancouver Sun were different than The Province. Why?

As it turned out… The Sun was an afternoon paper… it’d always show up around 5pm. The Province was an early-morning paper, always there by breakfast. In our home, we got both. And here was the thing…. by the time The Sun needed to go to print to make it for afternoon deliveries, the stock markets weren’t closed yet. The price listed in The Sun was the day’s mid-morning price, taken at… 11am? Noon? Not sure, but certainly well-before the 1:30pm market close. The Province the next morning had the closing prices from the previous day… and so, differences in price. And by scouring for prices that were higher in The Province, I could “buy” them with yesterday’s lower price and hope the upswing held long enough that I could “sell” them at a higher price. Not all stocks that went up in that last hour of trading stayed up, all through the next day, in time to sell them… but something like 80% of them did, which is staggeringly-high, well-beyond any typical financial wizardry from even the best analysts.

My wiggly line started heading north pretty quickly after that, much like the Mt. St. Helens ash plume… and with almost as much vertical force. Within a week, I’d caught up to the competition…. and just kept rolling… which led to the teacher asking me to stay after school that next Friday. “OK, what’s going on here?”, he asked. Of course, I couldn’t keep my mouth shut… I was so proud of being so clever and figuring out this loophole. I spilled everything. “Do you think that’s fair?”, he asked me… and my simple question back was, “Is it against the rules?”

From there, we had an interesting discussion about The Rules vs. The Spirit Of The Rules. What rules? The stock market is a game where you’re trying to win, and to win, you have to out-think someone else. Where in the rules does it say I can’t do this? Yes, I realize this isn’t possible in reality, but this is not real. It’s a game, and I found a better way to play it.

And after that, although I think he was impressed by my resourcefulness, he changed the rules. All trades must be submitted in the morning, using that morning’s quotes from The Province. End of advantage, and I ended up losing because one of those other guys sold everything, and put it all onto one particular stock which shot up on the very last day. Because asking daddy for inside information is ok, but figuring out how to play the game better… is not. Yes, I’m still bitter.

So… there are rules.… some rules, archaic and irrelevant, are meant to be broken. Some rules, for the greater good, need to be adhered to. Then… there’s that grey area of bending rules. Today, here in B.C., the rules have changed. We have had rules in place for more than a couple of months, and they have served us well. So well, that many people will insist we never needed them, and that is very wrong. Either way, as of today, with our rule changes, it’s one step forward towards a return to normal.

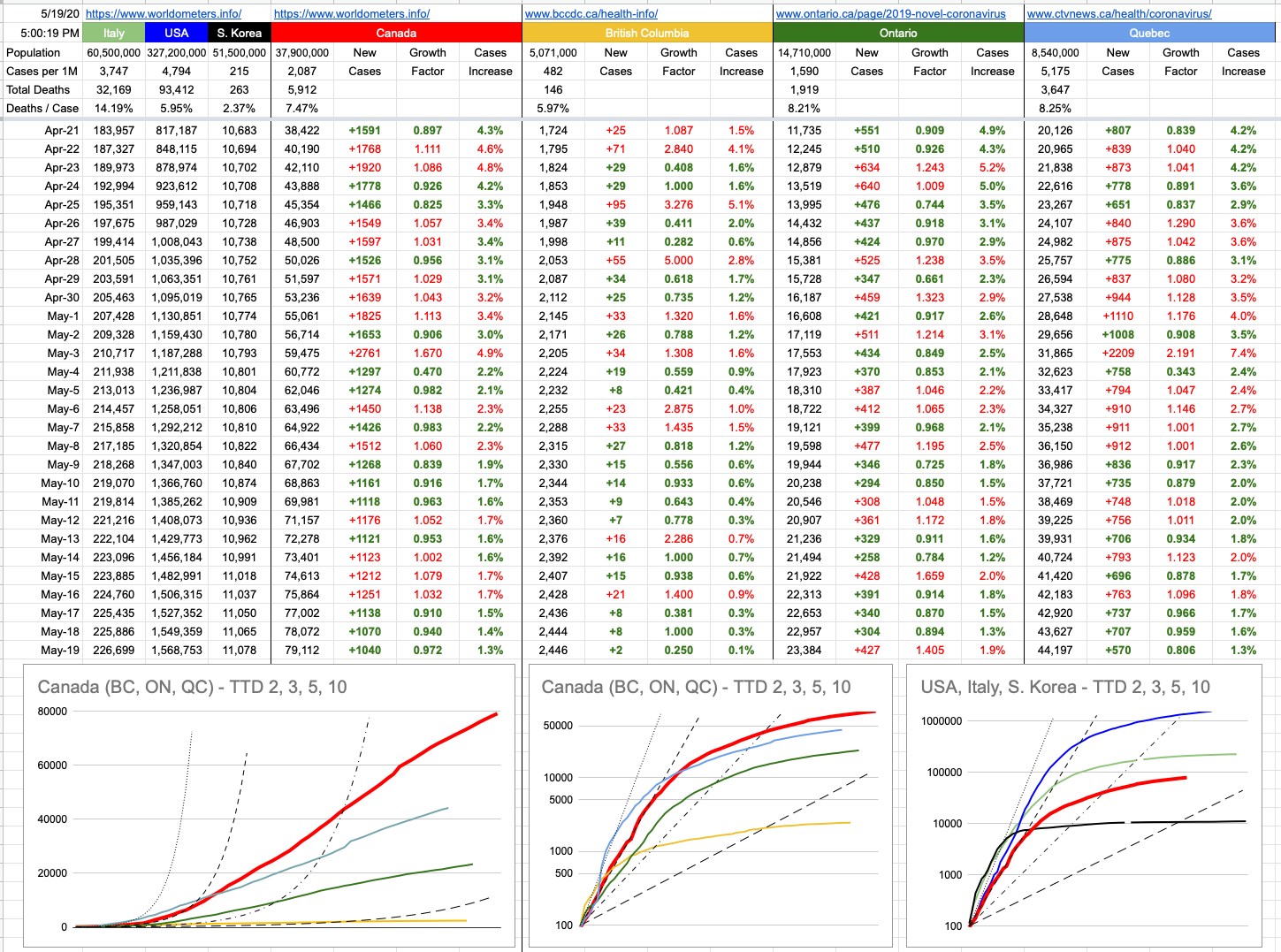

On the assumption that the people who make these rules know what they’re talking about — and, given their success, they certainly do — we should follow them. Indeed, our local rules and implementation thereof have become a model not just for Canada or North America, but the entire world. For populations of 5 million plus, we are number one. I would really love to see us stay there. Some people will break those rules. Some people will bend them… but I suggest, let’s try to stick to them. And if you think you can’t stick to the rules, at least consider the spirit of the rules. It’s not just about you. The stakes are a lot higher than those wiggly lines on a large paper chart from 40 years ago. Look at the wiggly lines on the charts attached to this post, especially the yellow one. Especially today. That is success. That is a win. Let’s all do our part to keep it there. Let’s keep rolling.

View Original Post and All Comments on Facebook

Leave A Comment