Isn’t in fun when your credit card info gets compromised, and your card gets cancelled… and you have to notify all 38 different auto-billers of the new card number… such a great use of time. Kudos though, to VISA and MC, whose AI fraud-detection these days seem to work quite well. Instantly flagged were $1,000+ online purchases at a number of high-end fashion retailers. Not quite in character for me.

I got sort-of wrongly accused of credit card fraud one time… I was in Calgary, and just before flying home, I filled up the tank of the rental car at the airport gas station before returning it.

Upon landing in Vancouver, I picked up my car from the parking lot and filled it up with gas at that little gas station wedged between the entrance/exit roads to YVR. This was 20 years ago, before pay-at-the-pump was a thing. In fact, before pre-paying for gas was a thing.

I filled up my tank and went inside, and gave the guy my card. He ran it… and his expression changed.

“Uhh… it didn’t go through”.

“Oh, that’s weird… should be fine… I just used it.”

“I’ll call VISA.”

“Sure… actually, don’t bother… here, I’ll pay cash.”

“Yeah… umm… I’m going to call them.”

“Seriously, don’t bother… here’s the cash.”

But he wouldn’t take the cash, and he wouldn’t return the card. And then I started wondering what little message must have popped-up on his machine… Fraud alert? Destroy card? Call police?

It makes some sense… buying gas 2 hours apart with the same physical card… at two gas stations more than 1,000km apart… ok, that’s fair. We got it quickly resolved… but, in fairness, that should have set off some alarm bells.

You know what else sets off alarm bells, but doesn’t get resolved so easily? Disney World in Florida is opening up this weekend.

Trust me, I am well-aware of the financial problems this pandemic is causing. I’m very familiar with plenty of economic forecasts and cash-flow projections that, at present, have zeros for top-line revenue. Do you know how many companies have zeros up there when they’re planning their budgets? Zero. Because, without revenue, you don’t have a business.

Surviving to live another day has been a well-discussed topic, but I’m not going to write about government incentives or job losses… I’m just going to talk about Disney. Disney is a public company, so they have to disclose a bunch of information, and one of the things they disclose is how much cash they have in the bank… defined as cash, or highly-liquid investments that could be redeemed on short notice. Here’s how much cash they’ve had over the last few years:

2017: $4.0 billion

2018: $4.2 billion

2019: $5.4 billion

Up to March 31, 2020: $14.3 billion

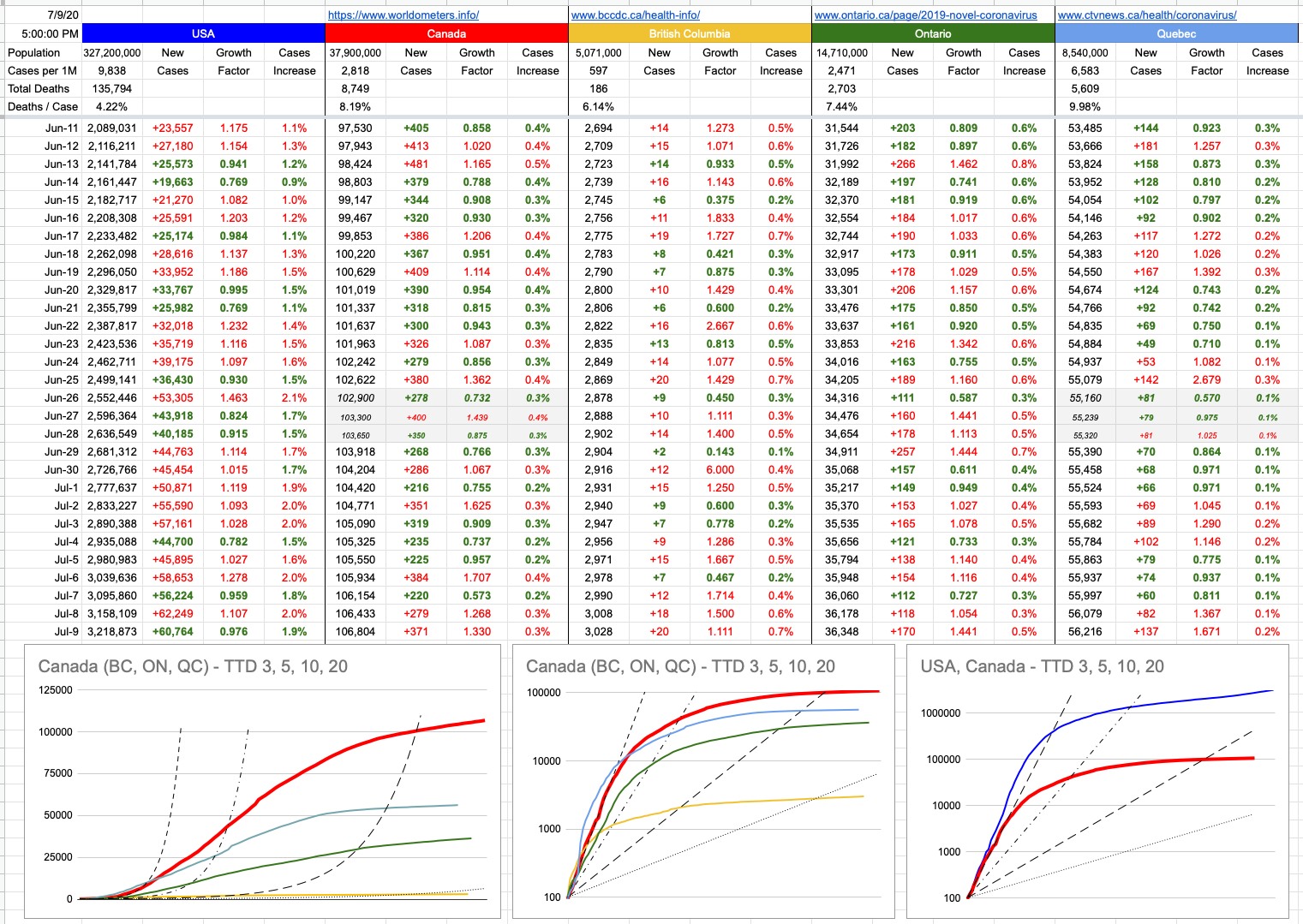

I don’t have a clue where that new $9 billion came from. Maybe they bought lots of shares in Zoom. It doesn’t matter… what matters is… that there are a lot of struggling companies that can’t afford to take a hit, but Disney isn’t one of them. They could most certainly afford to sit tight for bit… especially when Florida is seeing record numbers. Like… scary record numbers. Florida has a little more than half the population of Canada. Since July 1st, Canada has had 2,500 new cases. Florida has had 60,000.

At the risk of sounding a little too socialist… hey Disney, pay your people to sit around for another month or two. You can afford it. But your local hospitals can’t afford what you’re about to impose upon them. They already can’t… 56 Florida ICUs are at capacity, 35 others are at less than 10% availability… as Dr. Henry would tell you, “This is not the time.”

It’s easy to ring alarm bells. But it’s seeming difficult to get the right people to hear them.

View Original Post and All Comments on Facebook

Very well said (as usual). Seeing those numbers makes me even more disappointed in their decision to reopen.

I wouldn’t worry about Florida hospitals. Most people who go to Disneyworld come from another state. So they will get sick at Disneyworld, then take that disease back to their home state and use that hospital. And infect loads of other people in their community as well.

Have a nice day!

I’m not loving today’s numbers in Canada. Are we testing more? Or are we getting stupid?

Sage words.

It’s a small world after all

Is Disney actually profiting from COVID as everyone signs up for Disney+ to watch Hamilton?…. it was that just our family

Kymberly Jarder

Greed looks like a mouse sometimes.

I use a separate CC for all the recurring subscriptions and auto-pays and then that card NEVER leaves the vault for the very reason that you describe. I figure it lessens the chance of fraud and then the 38 notifications.

I was riveted to my computer as I read your latest post. Greed over humanity. It’s a sad world.????

I’d guess that DISNEY borrowed the extra billions at very very low rates??

fabulous analysis

????????????great message!